MORTGAGE LOAN MEASURE EXPLAINED

17-10-2024

Alphabetical Index

依字母搜索

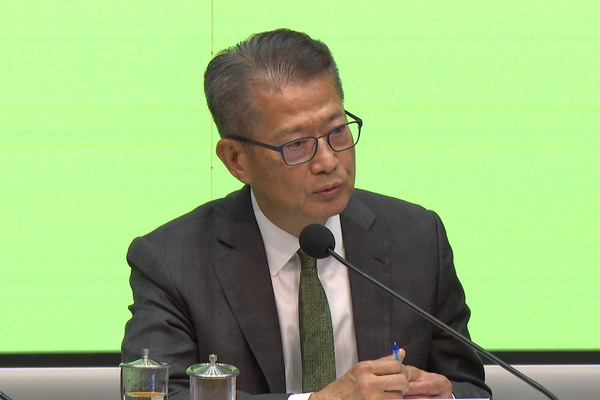

Financial Secretary Paul Chan today said he is confident that the Governmentâs adjustment of the maximum loan-to-value ratio for all properties to 70% will be conducive to the healthy and stable development of the Hong Kong property market.

Elaborating on the measure, announced in yesterdayâs Policy Address, at a press conference today, Mr Chan said the Government decided on the change after reviewing a whole range of factors.

âAbout the removal of all the macro-prudential measures, namely the loan-to-value (ratio) ceiling for bank loans, the property market, in terms of pricing, has come down quite a bit since September 2021. The market started to stabilise.

âThere would be around 108,000 first-hand units available in the next three to four years in terms of residential properties, so the supply would be enough.

âSo given those circumstances, we should not unduly impose measures to suppress the demand or try to prioritise the different demands.

âWe have decided to remove all those measures, (while) also taking into consideration that, at the moment, our banking sector is very healthy, very well capitalised.

âWe do feel confident (with) removing those restrictions so that we will be able to project a more positive expectation, if I may use that word, about the healthy and stable development of the Hong Kong property market.â

PREVIOUSNEXT

Latest Business News

最新商業資訊

10% rise in non-local firms hailed 20-12-2024

According to the latest annual survey jointly conducted by Invest Hong Kong (InvestHK) and the Census & Stati...

November sees 1.4% inflation 20-12-2024

Overall consumer prices rose 1.4% year-on-year in November, the same increase as in October, the Census & Statistics ...

Sun Dong promotes cybersecurity 19-12-2024

Secretary for Innovation, Technology & Industry Prof Sun Dong today officiated at the Cybersecurity Symposium 2024 an...

Base rate lowered to 4.75% 19-12-2024

The Monetary Authority announced today that it has decreased the base rate to 4.75% with immediate effect.

The decr...