INSTITUTIONAL GREEN BONDS ISSUED

18-7-2024

Alphabetical Index

依字母搜索

The Government today announced the successful offering of approximately HK$25 billion worth of green bonds denominated in renminbi (RMB), US dollars and euros under its Sustainable Bond Programme.

The bonds, which have been assigned credit ratings of AA+ by S&P Global Ratings and AA- by Fitch, are expected to be settled on July 24 and listed on the Hong Kong Stock Exchange and the London Stock Exchange.

Following a virtual roadshow on Tuesday, the bonds were priced yesterday, the Monetary Authority said.

They include an RMB2 billion 2-year tranche at 2.6%, an RMB2 billion 5-year tranche at 2.7%, an RMB2 billion 10-year tranche at 2.8%, an RMB2 billion 20-year tranche at 3.05%, an RMB2 billion 30-year tranche at 3.15%, a US$1 billion 3-year tranche at 4.336%, and a EUR750 million 7-year tranche at 3.379%.

The offering attracted participation from a wide spectrum of investors globally, with the equivalent of more than HK$120 billion being received in orders.

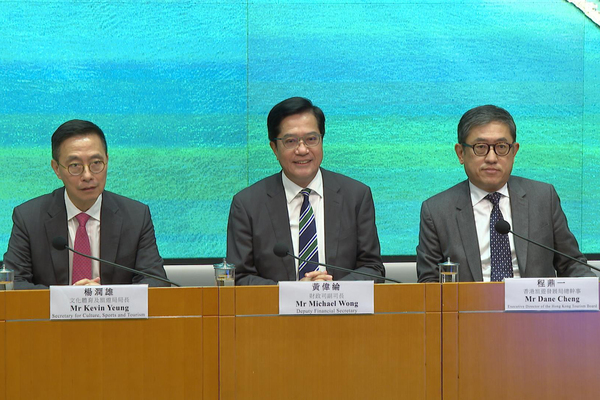

Financial Secretary Paul Chan said the issuance of Government green bonds is an important initiative to promote Hong Kong's low-carbon transformation and consolidate the city’s development as a green and sustainable finance hub.

“Global institutional investors responded enthusiastically to the subscription of these green bonds, reaffirming our efforts on this front,” he said.

“The inaugural offering of the 20-year and 30-year RMB bonds helps to extend the offshore RMB yield curve, further enrich offshore RMB product offerings, and promote RMB internationalisation in an orderly manner.”

PREVIOUSNEXT

Latest Business News

最新商業資訊

Inflation at 1.4% in October 21-11-2024

Overall consumer prices rose 1.4% year-on-year in October, a smaller rate of increase than the 2.2% seen in September, th...

Loop development outline announced 20-11-2024

The Government promulgated the Development Outline for the Hong Kong Park of the Hetao Shenzhen-Hong Kong Science & T...

Mega events set for 1st half of 2025 19-11-2024

At least 93 mega events will be held in Hong Kong in the first half of 2025, Deputy Financial Secretary Michael Wong anno...

Algernon Yau hosts trade reception 19-11-2024

Secretary for Commerce & Economic Development Algernon Yau today hosted a cocktail reception to update guests on the ...