MORE MEASURES TO SUPPORT SMES

18-10-2024

Alphabetical Index

依字母搜索

The Monetary Authority (HKMA), together with the banking sector, introduced multiple measures today to further support, through financing as well as banking products and services, the continuous development of small and medium-sized enterprises (SMEs).

The HKMA said around 20,000 SMEs have benefitted from the nine measures that it launched with the Banking Sector SME Lending Co-ordination Mechanism in March this year, involving an aggregate credit limit of over $44 billion.

Taking into account the commercial sectorâs views, the HKMA and the banking sector will roll out five measures to assist SMEsâ continuous development, upgrade and transformation, as well as enhancing their competitiveness and productivity to cope with various operational challenges.

Firstly, the HKMA has lowered the countercyclical capital buffer ratio from 1% to 0.5%, and will allow banks to early adopt the preferential treatments for SME exposures under the Basel III capital framework.

Such policies will release bank capital, enabling banks to make use of the additional capital to facilitate SMEsâ financing needs.

Secondly, the 16 banks that are active in SME lending have set aside a total of over $370 billion in dedicated funds for SMEs in their loan portfolio. The funds will allow SME customers to access necessary financing to cope with the evolving business environment.

The banks will regularly review and consider scaling up the size of their dedicated funds in response to SMEsâ needs and development.

â

Thirdly, the HKMA said banks will launch more credit products and services to meet the needs, such as the combination of digital transformation and green transformation, of SMEs. Examples include pre-approved credit limits, unsecured loans, cross-border loans, and loans with flexible repayment periods.

On partial principal repayment options, the HKMA noted that when an orderly exit from the banking sectorâs Pre-approved Principal Payment Holiday Scheme started in July 2023, the mechanism introduced enhanced measures to assist corporatesâ gradual return to normal repayment.

As some customersâ partial principal repayment arrangements will expire in early 2025, banks will be accommodative and consider offering more flexible repayment arrangements to these customers.

Subject to prudent risk-management principles, such arrangements may include extending the duration of partial principal repayment, offering more options on the proportion and duration of partial principal repayment, or even offering principal moratorium.

Additionally, banks will allocate adequate resources to process applications and work closely with HKMC Insurance to implement as soon as possible the principal moratorium and other enhanced measures under the SME Financing Guarantee Scheme.

PREVIOUSNEXT

Latest Business News

最新商業資訊

Loop development outline announced 20-11-2024

The Government promulgated the Development Outline for the Hong Kong Park of the Hetao Shenzhen-Hong Kong Science & T...

Mega events set for 1st half of 2025 19-11-2024

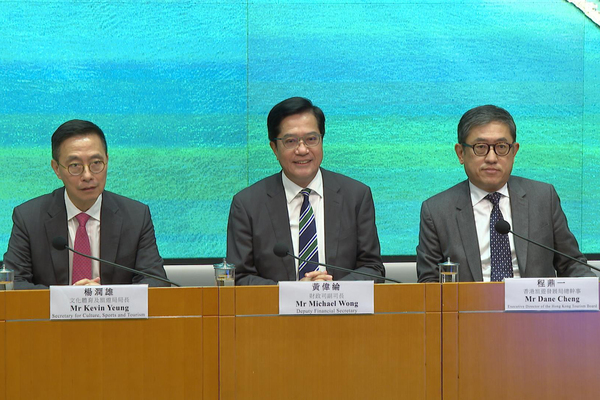

At least 93 mega events will be held in Hong Kong in the first half of 2025, Deputy Financial Secretary Michael Wong anno...

Algernon Yau hosts trade reception 19-11-2024

Secretary for Commerce & Economic Development Algernon Yau today hosted a cocktail reception to update guests on the ...

Vice Premier attends finance summit 19-11-2024

State Council Vice Premier He Lifeng today attended and delivered a keynote speech at the Global Financial Leadersâ ...