FINTECH WEEK STARTS

28-10-2024

Alphabetical Index

依字母搜索

Hong Kong FinTech Week 2024 opened today with its co-organiser, the Monetary Authority (HKMA), outlining a series of initiatives to spearhead fintech development in Hong Kong.

On asset tokenisation, the HKMA has completed the initial phase of six tokenisation use cases across four main themes under Project Ensemble and will publish a report detailing the results of the experimentation in 2025.

Its Architecture Community has also added three new members, and four new participants will begin experimenting with the Ensemble Sandbox on fixed income and investment funds use cases.

Building on the success of the two tokenised government green bond issuances under Project Evergreen, the HKMA is taking the project to the next phase by introducing a series of measures to promote the wider adoption of tokenisation in capital markets.

One of them is the Digital Bond Grant Scheme, which will offer a maximum grant of $2.5 million for each eligible issuance to incentivise digital bond issuance in Hong Kong and cultivate the local digital asset ecosystem.

Meanwhile, the authority has launched EvergreenHub, a knowledge repository where issuers, investors and other relevant market participants can reference its experience and related materials on the technological, legal and operational aspects of digital bond transactions as they navigate bond tokenisation.

The Monetary Authority is also driving the digital economy forward with Commercial Data Interchange (CDI), a next-generation data infrastructure that facilitates small and medium-sized enterprise (SME) lending.

To extend its reach, the authority is exploring a connection with the Land Registry by leveraging the CDI-CDEG (Consented Data Exchange Gateway) linkage to enhance mortgage and loan assessments for both individuals and corporates in phases from 2025. It is exploring pilots on cross-boundary credit referencing with Mainland credit reference platforms to enhance cross-boundary banking service offerings to SMEs.

To diversify data sources and enhance CDI functions for corporate lending, the HKMA has partnered with the Airport Authority to share cargo logistics data on the Hong Kong International Airport Cargo Data Platform with consent. A proof-of-concept exercise is underway to upgrade the Commercial Credit Reference Agency 2.0, providing analytics insights for a more efficient SME lending journey.

Additionally, Fintech Connect, Hong Kong's first cross-sectoral sourcing platform, was launched today to bridge financial institutions with fintech solution providers. The one-stop platform promotes precise matching of supply and demand for fintech services, fostering collaboration and innovation.

The HKMA, in partnership with Qianhai Authority, further enhances the platform by incorporating Qianhai-based fintech solution providers, fostering greater collaboration in the Greater Bay Area, and promoting mutual growth in the fintech ecosystem.

Speaking at FinTech Week, HKMA Chief Executive Eddie Yue said Hong Kong's financial sector must remain adaptable and open to new opportunities to further propel the growth of the industry.

âWe are committed to unlocking the full potential and advantage of fintech, and harnessing its power to drive sustainable growth of the ecosystem,â he added.

PREVIOUSNEXT

Latest Business News

最新商業資訊

Inflation at 1.4% in October 21-11-2024

Overall consumer prices rose 1.4% year-on-year in October, a smaller rate of increase than the 2.2% seen in September, th...

Loop development outline announced 20-11-2024

The Government promulgated the Development Outline for the Hong Kong Park of the Hetao Shenzhen-Hong Kong Science & T...

Mega events set for 1st half of 2025 19-11-2024

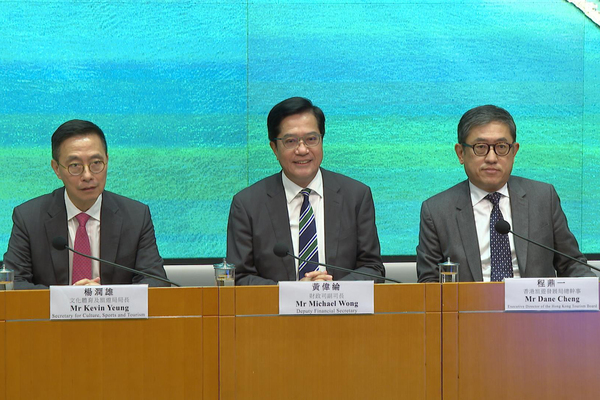

At least 93 mega events will be held in Hong Kong in the first half of 2025, Deputy Financial Secretary Michael Wong anno...

Algernon Yau hosts trade reception 19-11-2024

Secretary for Commerce & Economic Development Algernon Yau today hosted a cocktail reception to update guests on the ...