WEALTH SCHEME BROKERS SET

1-11-2024

Alphabetical Index

依字母搜索

The China Securities Regulatory Commission and the Securities & Futures Commission of Hong Kong issued announcements respectively today on the first batch of brokers eligible to participate in the Guangdong-Hong Kong-Macao Greater Bay Area Cross-boundary Wealth Management Connect Pilot Scheme.

The Hong Kong Special Administrative Region Government welcomed the announcements.

It said 14 licensed corporations in Hong Kong have been included in the first batch of brokers to offer cross-boundary investment services for bay area investors. These corporations will work in partnership with their Mainland partner brokers as confirmed by the China Securities Regulatory Commission.

The Hong Kong SAR Government also noted that with the first batch of brokers joining the scheme, the demand for asset allocation by bay area residents can be better satisfied, thereby engendering increased development opportunities for the industry.

It also strengthens Hong Kong's status as an international asset management centre, and contributes to the country's opening up of the financial market in a sustained and orderly manner.

The Hong Kong SAR Government added that it is grateful for Mainland and Hong Kong regulatorsâ unwavering efforts.

PREVIOUSNEXT

Latest Business News

最新商業資訊

SFST headed to Switzerland 3-11-2024

Secretary for Financial Services & the Treasury Christopher Hui will depart on a visit to Switzerland today, and will...

Sun Dong to visit Canada 3-11-2024

Secretary for Innovation, Technology & Industry Prof Sun Dong will depart today on a visit to Canada, where he will s...

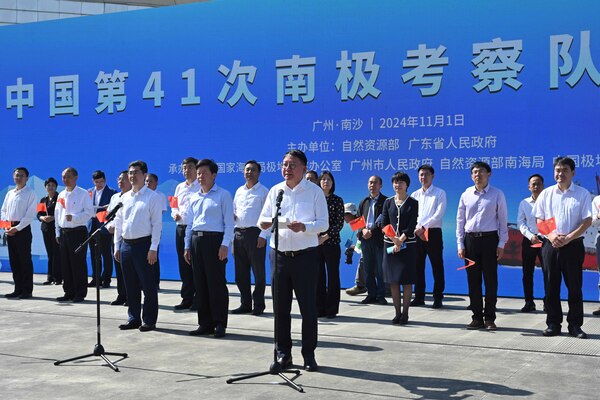

CS sends off polar expedition team 1-11-2024

Chief Secretary Chan Kwok-ki attended the send-off event of China's 41st Antarctic expedition team at the Guangzhou Nansh...

Wealth scheme brokers set 1-11-2024

The China Securities Regulatory Commission and the Securities & Futures Commission of Hong Kong issued announcements ...